Monthly LRA Update

Monthly LRA Update

REGULATORY DEVELOPMENTS

Banking Regulators Release Proposed Updates to Basel III Capital Rules

On July 27 the banking regulators released proposed rules to implement the final components of the Basel III agreement and to implement certain changes in response to the recent banking turmoil. The proposal primarily applies to banks with $100 billion or more in total consolidated assets.

Noteworthy proposed updates include

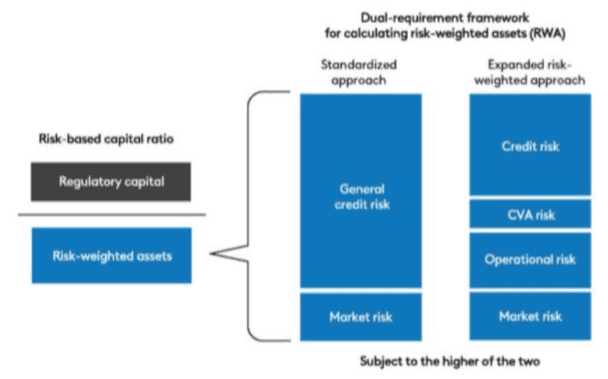

- Replacing the internal-models-based capital requirements for credit and operational risk (i.e., the so-called advanced approaches) with a new “expanded risk-based approach”;

- NOTE: We anticipate that these changes, if finalized, will have material implications for how large banks calculate RWA for BOLI programs.

- Maintaining the existing requirement for advanced approach banks to calculate RWA under two approaches (i.e., standardized and advanced measurements); however, as noted in the first item, the advanced measurements will be replaced with the expanded risk-based approach;

- Requiring banks with assets between $100-$700 billion to include unrealized gains and losses on AFS portfolios in the calculation of regulatory capital;

- Replacing the current approaches for measuring capital requirements for credit valuation adjustment (CVA) risk for OTC derivative contracts with non-model-based approaches, including a less burdensome option intended for less complex banking organizations; and

- Incorporating a number of changes to disclosure requirements – including information reported in call reports.

The expanded risk-based approach incorporates changes to the risk-weighting of a number of exposure types, including

- Exposures to banks and depository institutions (base risk weight increased from 20% to 40%);

- Corporate exposures (65% RW for investment grade exposure to an entity that has a publicly traded security outstanding, and a 100% RW to most other corporate exposures

- Derivatives (refinements to the SA-CCR methodology

- Equity exposures, including exposures to investment funds (remove the 100% RW category for “non-significant equity exposures”, increase the RW for exposures to leveraged investment firms, and implement a floor RW of 20% for investment funds)

- Investment fund exposures in particular (in addition to the changes described above, the rule would largely require the full look-through approach if the institution has sufficient information to calculate RWA for each of the exposures held by the fund and mandate a 1250% risk-weight if a bank was unable to perform either the full or alternative modified look through)

- Securitizations (would establish a new “securitization standardized approach” [SEC-SA] to replace the SSFA)

- Subordinated debt instruments (would be subject to a new definition and generally an RW of 150%)

The proposal sets forth a timeline and transition period whereby the expanded RWA and the AOCI inclusion in capital would be phased in over three years starting July 1, 2025. Other elements of the calculation of regulatory capital would apply upon the effective date of the rule.

The regulators estimate an aggregate 16% increase in common equity tier 1 capital requirements for affected banks from these proposals.

Comments on the proposal are open through November 30.

In the coming weeks, we will review this proposal more closely and further summarize the potential implications for risk weighting BOLI exposures.

TAX DEVELOPMENTS

IRS Reportable Policy Sale Proposed Update – Review of Comment Letters Submitted

As we have covered the past couple of months, the IRS has proposed rule changes for the application of the transfer for valuable consideration rules under the reportable policy sale (“RPS”) regulations arising in connection with IRC § 1035 exchanges of life insurance contracts and certain transfers of policies under business reorganizations. The comment period was open through July 10. In total, five comment letters were submitted. Last month, we highlighted the American Bankers Association letter.

Finseca, American Council of Life Insurers (ACLI), Prudential and Financial Solutions Partners, and International Bancshares Corporation submitted comments in July. We identify highlights of each below.

ACLI

The ACLI comment letter focused on the information reporting requirements and provided suggestions for how best to accomplish the goal of maintaining the correct distinction of whether or not a policy that is exchanged pursuant to section 1035 is an RPS.

The ACLI expressed agreement with the Proposed Regulations position that a 1035 exchange is not an RPS.

Finseca

With respect to section 1035 exchanges, Finseca cautioned that a life insurance policy must qualify under applicable state insurance laws (particularly insurable interest laws) to qualify for the federal tax treatment under section 7702(a). As such, Finseca suggested that IRS and Treasury may wish to clarify that a contract issued as part of a purported section 1035 exchange remains subject to other requirements of the tax code.

With respect to ordinary course business transactions, Finseca encouraged the IRS to extend the “de minimis exemption” to transactions other than those qualifying under section 368(a) and to expand the applicability to entities other than C corporations. Finseca provided a six-page annex analyzing the potential tax treatment of various possible transactions and an assessment of how likely a transaction would be to not give rise to a reportable policy sale.

International Bancshares Corporation (IBC)

IBC supports the proposed regulations as it relates to section 1035 exchanges. As reflected in the following excerpt, the bank appears to interpret the changes as negating (or possibly negating) the applicability of section 264(f) as it relates to exchanges of policies on former employees.

We applaud Treasury for modifying the final regulations to allow employers to pursue Section 1035 exchanges covering the lives of persons who are no longer actively employed. Although we understand that the Proposed Regulations render the employee exception in Revenue Ruling 2011-9 moot, we believe the Proposed Regulations could make this important point more clearly.

IBC concurred with the proposed regulation to maintain a contract’s RPS status after a 1035 exchange.

IBC requested confirmation of certain guidance set forth in IRS Notice 2009-48 (presumably, that such guidance continues to apply). IBC also requested confirmation that “an enhancement of policy cash value by the new carrier to offset a loss of the exchanged value from the old policy would not be treated as a taxable event.”

Prudential and Financial Solutions Partners

Davis & Harman LLP (“D&H”) submitted a comment letter on behalf of Prudential and Financial Solutions Partners. D&H fully supports the proposed regulations, and in particular the provisions regarding exchanges under section 1035. This comment letter provided additional thoughts in support of the conclusions reached by the proposed regulations, including

- The Proposed Regulations correctly conclude that a section 1035 exchange, in and of itself, is not a “transfer” of the newly-issued contract received in the exchange.

- Issuing a policy is not a transfer.

- Section 1035 exchanges have never triggered the transfer-for-value rule.

- If issuance of a policy in a 1035 exchange were treated as a “transfer” under the transfer-for-value rule, the carryover basis exception would never apply.

- The Proposed Regulations are not inconsistent with section 101(j).

- State insurable interest laws remain relevant.

We find the D&H analysis and conclusions persuasive throughout.

OTHER DEVELOPMENTS

CA Attorney General Seeks Information from Employers on Compliance with CCPA

On July 14 California Attorney General Rob Bonta announced an investigative sweep, through inquiry letters sent to large California employers requesting information on the companies’ compliance with the California Consumer Privacy Act (CCPA) with respect to the personal information of employees and job applicants. Prior to 2023, the CCPA exempted personnel data from the act; however, that exemption expired on January 1, 2023 (when the CA legislature did not extend the exemption).

As such, covered businesses must comply with the CCPA as it relates to employee data. Businesses subject to the CCPA have specific legal obligations, such as providing notice of privacy practices and fulfilling consumer requests to exercise their rights to access, delete, and opt out of the sale and sharing of personal information.

In a separate development, the Superior Court of California (Sacramento Division) issued a ruling on June 30 delaying enforcement of regulations under the California Privacy Rights Act of 2020 (“CPRA”) until one year after adoption (March 29, 2024). The Court also ruled that future CPRA regulations could not be enforceable until one year after adoption.

Several law firms, including Gibson Dunn and Groom Law Group have provided helpful summaries of this development.

Docket: California Chamber of Commerce vs. California Privacy Protection Agency 34-2023-80004106-CU-WM-GDS

Society of Actuaries U.S. Individual Life COVID-19 Reported Claims Analysis

The Society of Actuaries released an updated report on the impact of COVID-19 on the individual life insurance industry’s mortality experience. This report documents a high-level analysis of the claims that have been reported through December 31, 2022.

Below is a table from the report that presents claim counts for each quarter since 2020 as a ratio to an average determined from 2017-2019. It shows that claims for insureds age 70+ appear to remain elevated.