Monthly LRA Update

Monthly LRA Update

TAX DEVELOPMENTS

IRS Final Guidance on Transition from LIBOR to Other Reference Rates

On January 4 Final Regulations from the IRS were published in the Federal Register providing guidance on the tax consequences of the transition away from LIBOR in debt instruments, derivative contracts, and other contracts. The Final Regulations supersede the previous Proposed Regulations that were issued in October 2019.

Highlights of the Final Regulations include

- Delineation between “covered modifications” (those that are not treated as an exchange of property for other property differing materially in kind or in extent for purposes of § 1.1001-1(a)) and “noncovered modifications” (any portion of a modification of a contract that is not a covered modification).

- “Associated modifications” are treated as covered modifications. An associated modification is a modification of the technical, administrative, or operational terms of a contract that is reasonably necessary to adopt or to implement the modifications described in paragraph (h)(1)(i), (ii), or (iii) of this section other than associated modifications. An associated modification also includes an incidental cash payment intended to compensate a counterparty for small valuation differences resulting from a modification of the administrative terms of a contract, such as the valuation differences resulting from a change in observation period.

- Elimination of the fair market value requirement of the Proposed Regulations that required the fair market value of the contract to be substantially equivalent before and after the modification. Instead, the Final Regulations set forth a list of modifications that will fail to qualify as covered modifications.

- Clarification that a change to the terms of the debt instrument or contract that results from the activation of a fallback rate also must be tested at the time of activation.

The Final Regulations will become effective on March 7.

IRS Notice 2022-6 – Determination of Substantially Equal Periodic Payments

The most recent Internal Revenue Bulletin (released January 31) included IRS Notice 2022-6, which provides guidance on whether a series of payments from an individual account under a qualified retirement plan is considered a series of substantially equal periodic payments within the meaning of IRC § 72(t)(2)(A)(iv). The guidance also applies for purposes of determining whether distributions from a non-qualified annuity contract are a series of substantially equal periodic payments within the meaning of IRC § 72(q)(2)(D).

IRS Notice 2022-6 also provides a 5% floor on the maximum interest rates that may be used to calculate annuity payments under the fixed amortization and annuitization methods.

The guidance in this notice replaces the guidance in Rev. Rul. 2002-62 and Notice 2004-15 for any series of payments commencing on or after January 1, 2023, and it may be used for a series of payments commencing in 2022.

REGULATORY DEVELOPMENTS

SEC Reopens Comment Period on Executive Compensation Proposal

On January 27 the SEC announced that it was reopening the comment period for its proposal to implement Section 953(a) of the Dodd-Frank Act. The proposed rules were first released in the Federal Register in May 2015.

The Proposed Rules would add new 17 CFR 229.402(v) (“Item 402(v) of Regulation S-K”), which would require registrants to describe how the executive compensation actually paid by the registrant related to the financial performance of the registrant over the time horizon of the disclosure. The Proposed Rules would use cumulative total shareholder return (“TSR”), as defined in 17 CFR 229.201(e) (“Item 201(e) of Regulation S-K”), as the measure of financial performance and require registrants to report a table of information relating to the relationship between executive compensation and TSR.

According to the SEC press release, the comment period will be reopened for 30 days following publication in the Federal Register.

JUDICIAL DEVELOPMENTS

Court Provides Preliminary Approval of Class Action Settlement in John Hancock COI Litigation

On January 10 the US District Court (SD NY) provided preliminary approval of the class action settlement in Leonard v. John Hancock. Please refer to our October 2021 LRA Update for a brief summary of this COI litigation and the proposed settlement.

A Final Fairness Hearing has been set for May 17.

Docket: Leonard, et al. v. John Hancock Life. Ins. Co. of New York and John Hancock Life Insurance Company (U.S.A.), No. 18-cv-4994-AKH

OTHER DEVELOPMENTS

Society of Actuaries Releases U.S. Population Mortality Observations

In January the Society of Actuaries released a report entitled “U.S. Population Mortality Observations – Updated with 2020 Experience.” The SOA relied upon data furnished by the CDC.

Key highlights set forth in the executive summary of the report include

- The overall age-adjusted mortality rate (both sexes) from all causes of death recorded the historically highest increase of published records dating back to 1900 of 16.8% in 2020, following a 1.2% decrease in 2019. The increase eclipsed the size of recent years’ annual volatility and exceeded the 11.7% increase in 1918 that occurred during the Spanish influenza pandemic. When COVID deaths are removed, all other CODs’ (Cause of Death) combined mortality increased by 4.9%, which was last exceeded by a 5.6% increase in 1936.

- All other CODs featured in this report had increased 2020 mortality.

- Heart disease and Alzheimer’s/Dementia had 4.7% and 7.8% increases, respectively.

- Diabetes, liver and hypertension had increases of 14.9%, 16.0% and 13.3%, respectively.

- The external CODs of assaults and opioid overdoses had extreme increases at ages 15-24 of 35.9% and 61.2%, respectively.

- The impact of just COVID varied by age and sex.

- Ages under 5 were largely untouched by COVID.

- The COVID increment was 0.9% for both sexes at ages 5-14 and peaked at ages 75-84 at 12.4% and 14.9% for females and males, respectively.

- The increment was slightly lower for ages 85 at 11.7% and 13.5% for females and males, respectively.

- Overall, COVID contributed -11.9% of the total -16.8% 2020 mortality improvement.

- The opioid drug overdose death rate increased by 37.6% in 2020, which followed a 6.3%% increase in 2019. The extreme deterioration of mortality in 2020 leaves 2018 as the only year from 2000-2020 with improved mortality and exceeded the next highest of 27.4% that occurred in 2016. Although opioid mortality rates are much lower than other major CODs, their 2020 one-year mortality rates stood out as extreme and historic in terms of their level and change from 2019. The highest 2020 one-year mortality increases for females and males occurred at ages 15-24 for both sexes. Those 2020 one-year increases for females and males were 50.1% and 65.7%, respectively.

The SOA webpage includes five separate interactive dashboards that allow an interested user to filter and drill down further into the information.

Columbian Mutual Life Settlement with NY DFS for Failing to Pay Unclaimed Proceeds

On January 11 the NY DFS announced a consent order entered into with Columbian Mutual Life due to its failure to comply with NY law governing unclaimed life insurance proceeds. Columbian Mutual will pay approximately $7.83 million in restitution to New York consumers, plus $3 million in penalties to NY.

Acting Superintendent of Financial Services Adrienne Harris noted, “In failing to properly conduct required cross-checks with Social Security records and promptly paying beneficiaries, Columbian Mutual did not honor its payment obligations to numerous beneficiaries of deceased policyholders….”

We do not believe this development will directly impact any BOLI/COLI policies; however, we embrace efforts for insurers to monitor and process death claims based on Social Security records.

FRB Invites Public Comment on Proposed Guidance for Supervision of Certain Insurance Organizations Overseen by the Board

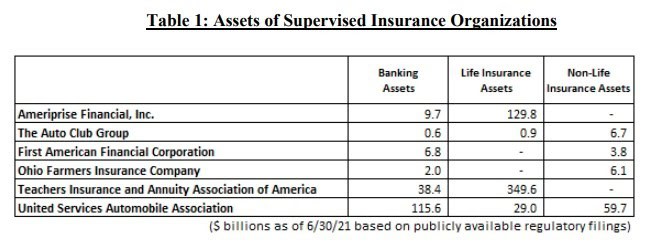

On January 28 the FRB invited public comment on proposed guidance to implement a framework for the supervision of depository institution holding companies significantly engaged in insurance activities. The FRB has supervised a small number of these entities since 2011 when Dodd-Frank transferred the responsibility to the FRB from the Office of Thrift Supervision.

The proposed framework consists of a risk-based approach to communicating supervisory expectations, assigning supervisory resources, and conducting supervisory activities; a unique supervisory rating system; and a description of how examiners would work with state insurance regulators to limit the burden associated with supervisory duplication.

A depository institution holding company is considered to be a supervised insurance organization if it is an insurance underwriting company or if over 25 percent of its consolidated assets are held by insurance underwriting subsidiaries. The memorandum released by the FRB includes a table of firms that are currently within the scope of this proposed framework. The firms do not appear to include any BOLI/COLI issuers.